A Job Costing System Can Be Used by Which Types ofã¢â‚¬â€¹ Companies?

Process Costing

27 Compare and Contrast Job Club Costing and Procedure Costing

As you've learned, job order costing is the optimal accounting method when costs and production specifications are not identical for each product or client simply the direct material and direct labor costs can easily be traced to the final product. Job guild costing is often a more than circuitous system and is appropriate when the level of detail is necessary, as discussed in Chore Order Costing. Examples of products manufactured using the task club costing method include tax returns or audits conducted by a public accounting house, custom furniture, or, in a comprehensive example, semitrucks. At the Peterbilt factory in Denton, Texas, the company can build over 100,000 unique versions of their semitrucks without making the same truck twice.

Process costing is the optimal costing system when a standardized procedure is used to manufacture identical products and the directly cloth, straight labor, and manufacturing overhead cannot be easily or economically traced to a specific unit of measurement. Process costing is used most often when manufacturing a product in batches. Each department or production process or batch process tracks its direct material and direct labor costs too every bit the number of units in production. The actual cost to produce each unit through a process costing system varies, but the average event is an adequate determination of the cost for each manufactured unit of measurement. Examples of items produced and deemed for using a grade of the procedure costing method could be soft drinks, petroleum products, or fifty-fifty article of furniture such as chairs, assuming that the company makes batches of the aforementioned chair, instead of customizing final products for private customers.

For example, pocket-size companies, such as David and William's, and large companies, such as Nabisco, use similar cost-determination processes. In order to sympathize how much each production costs—for example, Oreo cookies—Nabisco uses process costing to rails the directly materials, direct labor, and manufacturing overhead used in the manufacturing of its products. Oreo production has six distinct steps or departments: (1) make the cookie dough, (2) press the cookie dough into a molding machine, (3) bake the cookies, (4) brand the filling and apply information technology to the cookies, (5) put the cookies together into a sandwich, and (6) and place the cookies into plastic trays and packages. Each section keeps rail of its straight materials used and direct labor incurred, and manufacturing overhead applied to facilitate determining the price of a batch of Oreo cookies.

As previously mentioned, process costing is used when similar items are produced in big quantities. As such, many individuals immediately acquaintance procedure costing with assembly line production. Process costing works best when products cannot exist distinguished from each other and, in improver to obvious production line products similar ice foam or paint, also works for more complex manufacturing of similar products similar small engines. Conversely, products in a job society cost system are manufactured in modest quantities and include custom jobs such every bit custom manufacturing products. They can also be legal or accounting tasks, movie product, or major projects such equally construction activities.

The difference between procedure costing and task order costing relates to how the costs are assigned to the products. In either costing system, the power to obtain and clarify cost information is needed. This results in the costing system selected being the one that all-time matches the manufacturing procedure.

A job order price organisation is frequently more expensive to maintain than a bones process costing system, since there is a cost associated with assigning the private cloth and labor to the product. Thus, a job social club price organization is used for custom jobs when it is easy to determine the price of materials and labor used for each job. A procedure cost system is oft less expensive to maintain and works best when items are identical and it is difficult to trace the verbal cost of materials and labor to the final production. For instance, assume that your company uses three production processes to make jigsaw puzzles. The first process glues the picture on the cardboard backing, the 2d process cuts the puzzle into pieces, and the final procedure loads the pieces into the boxes and seals them. Tracing the complete costs for the batch of similar puzzles would likely entail iii steps, with three dissever costing organization components. In this environment, it would exist difficult and not economically viable to trace the exact materials and the exact labor to each private puzzle; rather, it would be more efficient to trace the costs per batch of puzzles.

The costing system used typically depends on whether the company can most efficiently and economically trace the costs to the job (favoring chore order costing system) or to the product department or batch (favoring a procedure costing arrangement).

While the costing systems are unlike from each other, management uses the information provided to brand similar managerial decisions, such equally setting the sales price. For example, in a task order toll organisation, each task is unique, which allows management to establish private prices for individual projects. Management also needs to establish a sales price for a production produced with a procedure costing organization, but this organization is non designed to stop the production procedure and individually cost each batch of a product, so management must set a toll that volition work for many batches of the production.

In addition to setting the sales price, managers need to know the cost of their products in order to determine the value of inventory, plan production, determine labor needs, and make long- and short-term plans. They too demand to know the costs to make up one's mind when a new product should be added or an onetime product removed from product.

In this chapter, yous volition learn when and why process costing is used. Yous'll also learn the concepts of conversion costs and equivalent units of production and how to use these for computing the unit and total price of items produced using a process costing organization.

Basic Managerial Accounting Terms Used in Job Social club Costing and Process Costing

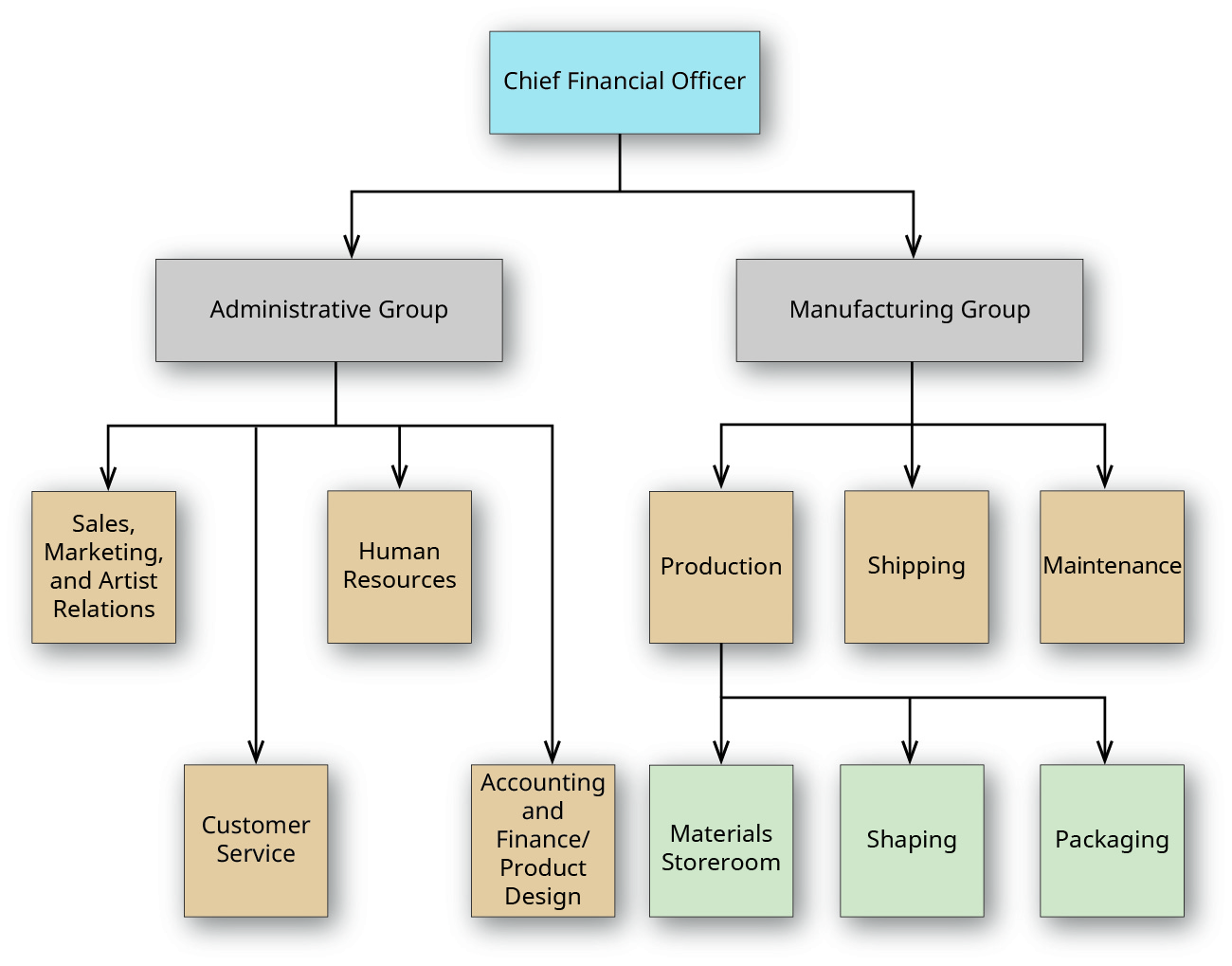

Regardless of the costing organization used, manufacturing costs consist of directly material, direct labor, and manufacturing overhead. (Figure) shows a partial organizational chart for Stone City Percussion, a drumstick manufacturer. In this case, two groups—administrative and manufacturing—report directly to the primary fiscal officer (CFO). Each group has a vice president responsible for several departments. The organizational chart also shows the departments that written report to the product section, illustrating the product arrangement. The material storage unit stores the types of wood used (hickory, maple, and birch), the tips (nylon and felt), and packaging materials.

The Organizational Nautical chart for Rock Urban center Percussion. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA iv.0 license)

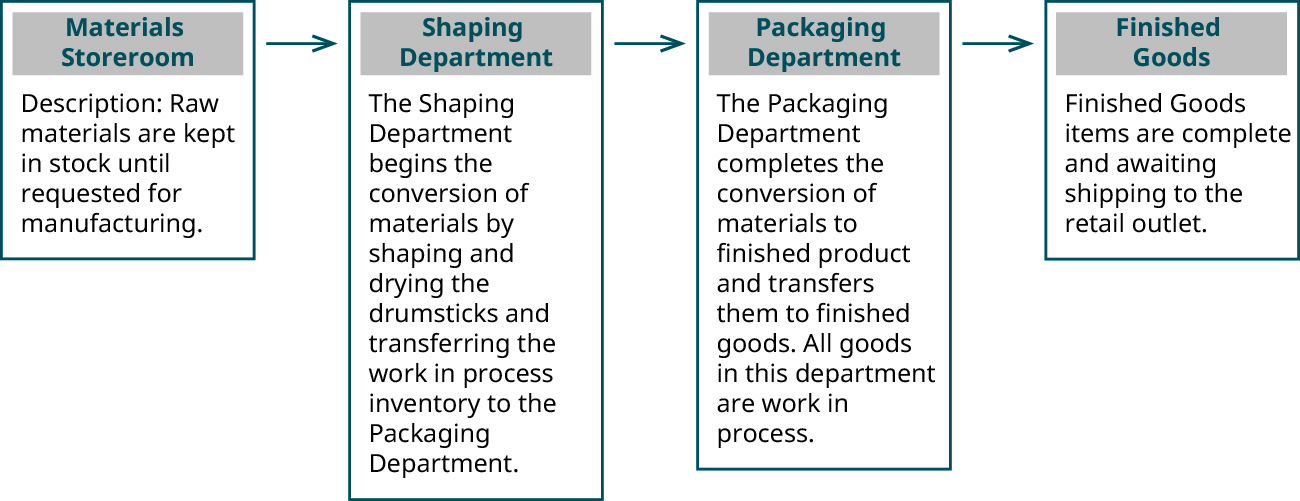

Agreement the company's organization is an important first step in whatsoever costing system. Side by side is agreement the product process. The most basic drumstick is made of hickory and has a wooden tip. When the popular size 5A stick is manufactured, the hickory stored in the materials storeroom is delivered to the shaping department where the wood is cutting into pieces, shaped into dowels, and shaped into the size 5A shape while under a stream of water. The sticks are stale, and and so sent to the packaging department, where the sticks are embossed with the Rock City Percussion logo, inspected, paired, packaged, and shipped to retail outlets such as Guitar Center. The manufacturing process is described in (Figure).

Rock Urban center Percussion Manufacturing Process. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license)

The different units within Rock City Percussion illustrate the two main price categories of a manufacturing company: manufacturing costs and administrative costs.

Understanding the total manufacturing procedure for a product helps with tracking costs. This video on how drumsticks are made shows the production process for drumsticks at one visitor, starting with the raw forest and ending with packaging.

Manufacturing Costs

Manufacturing costs or product costs include all expenses required to manufacture the product: directly materials, straight labor, and manufacturing overhead. Since process costing assigns the costs to each section, the inventory at the finish of the menstruation includes the finished goods inventory, and the piece of work in procedure inventory for each manufacturing department. For example, using the departments shown in (Figure), raw materials inventory is the price paid for the materials that remain in the storeroom until requested.

While still in production, the work in procedure units are moved from one department to the next until they are completed, so the work in process inventory includes all of the units in the shaping and packaging departments. When the units are completed, they are transferred to finished goods inventory and become costs of goods sold when the product is sold.

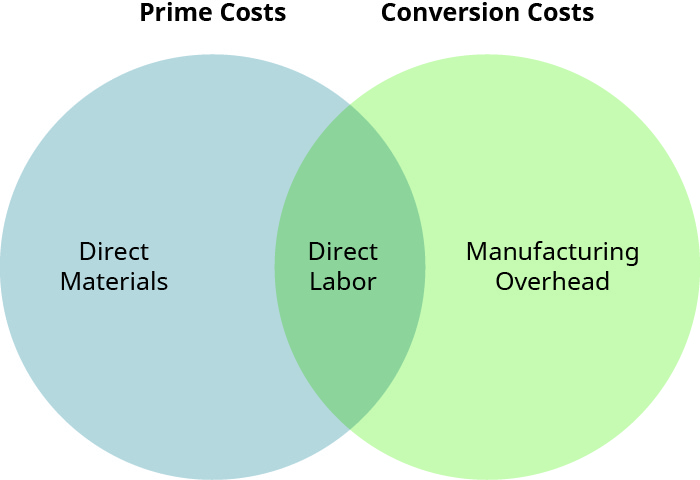

When assigning costs to departments, it is important to separate the production costs from the period costs, which are those that are typically related with a particular time period, instead of fastened to the product of an asset. Management often needs additional information to make decisions and needs the product costs further categorized as prime costs or conversion costs ((Effigy)). Prime costs are costs that include the master (or direct) production costs: direct material and direct labor. Conversion costs are the costs necessary to convert straight materials into a finished product: direct labor and manufacturing overhead, which includes other costs that are not classified equally direct materials or directly labor, such as plant insurance, utilities, or property taxes. Also, note that directly labor is considered to exist a component of both prime number costs and conversion costs.

Prime Costs and Conversion Costs. Production costs can be categorized as prime number costs (direct production costs) or conversion costs (costs incurred while converting the materials into a finished production). Direct labor is accounted for in both categories. (attribution: Copyright Rice Academy, OpenStax, under CC BY-NC-SA four.0 license)

Job order costing tracks prime costs to assign directly material and direct labor to individual products (jobs). Process costing besides tracks prime costs to assign direct material and directly labor to each production department (batch). Manufacturing overhead is another cost of production, and it is applied to products (job gild) or departments (process) based on an appropriate activeness base.

The Unethical Baker Auditorane , 2

According to the Federal Bureau of Investigation (FBI), "Sandy Jenkins was a shy, daydreaming accountant at the Collin Street Baker, the world's well-nigh famous fruitcake company. He was tired of feeling invisible, so he started stealing—and got a little carried away." Beingness unethical netted the accountant ten years in federal prison, and his wife Kay was sentenced to five years' probation and 100 hours of community service, and she was required to write a formal apology to the bakery. According to the FBI, "Jenkins spent over $11 million on a Black American Limited card alone—roughly $98,000 per month over the course of the scheme—for a couple that had a legitimate income, through the Bakery, of approximately $50,000 per year."

How did this happen? Texas Monthly reports that Sandy plant a fashion to write unapproved checks in the accounting organization. He implemented his accounting arrangement and created checks that were "signed" by the owner of the company, Bob McNutt. McNutt was perplexed as to why his bakery was not more profitable year after year. The accountant was stealing the coin while making the stolen checks appear to be paying for fabric costs or operating costs. According to Texas Monthly, "Once Sandy was sure that nobody had noticed the first fraudulent check, he tried it again. And again and again. Each time, Sandy would repeat the scheme, pairing his fraudulent check with one that appeared legitimate. Someone would have to closely examine the checks to run into whatever discrepancies, and that seemed unlikely." The multimillion dollar fraud was exposed when another accountant looked closely at the checks and noticed discrepancies.

Selling and Administrative Expenses

Selling and authoritative (S&A) expenses are period costs, which means that they are recorded in the period in which they were incurred. Selling and administrative expenses typically are not directly assigned to the items produced or services provided and include costs of departments not directly associated with manufacturing but necessary to operate the business. The selling costs component of Southward&A expenses is related to the promotion and sale of the company's products, while authoritative expenses are related to the administration of the company. Some examples of S&A expenses include marketing costs; administration building rent; the chief executive officeholder's salary expense; and the accounting, payroll, and data processing department expenses.

These full general rules for South&A expenses, withal, have their exceptions. For example, some items that are classified as overhead, such equally institute insurance, are period costs but are classified equally overhead and are fastened to the items produced as product costs.

The expense recognition principle is the primary reason to separate the costs of production from the other expenses of the company. This principle requires costs to be recorded in the period in which they are incurred. The costs are expensed when matched to the revenue with which they are associated; this is commonly referred to every bit having the expenses follow the revenues.

Catamenia costs are expensed during the menses in which they are incurred; this allows a company to apply the authoritative and other expenses shown on the income statement to the same period in which the company earns income. Nether generally accepted accounting principles (GAAP), separating the production costs and assigning them to the department results in the costs of the production staying with the work in process inventory for each department. This follows the expense recognition principle considering the cost of the product is expensed when acquirement from the auction is recognized.

Equivalent Units

In a process price system, costs are maintained past each department, and the method for determining the cost per individual unit is dissimilar than in a job order costing system. Rock City Percussion uses a procedure cost system because the drumsticks are produced in batches, and it is not economically feasible to trace the direct labor or direct material, like hickory, to a specific drumstick. Therefore, the costs are maintained by each department, rather than by job, every bit they are in job order costing.

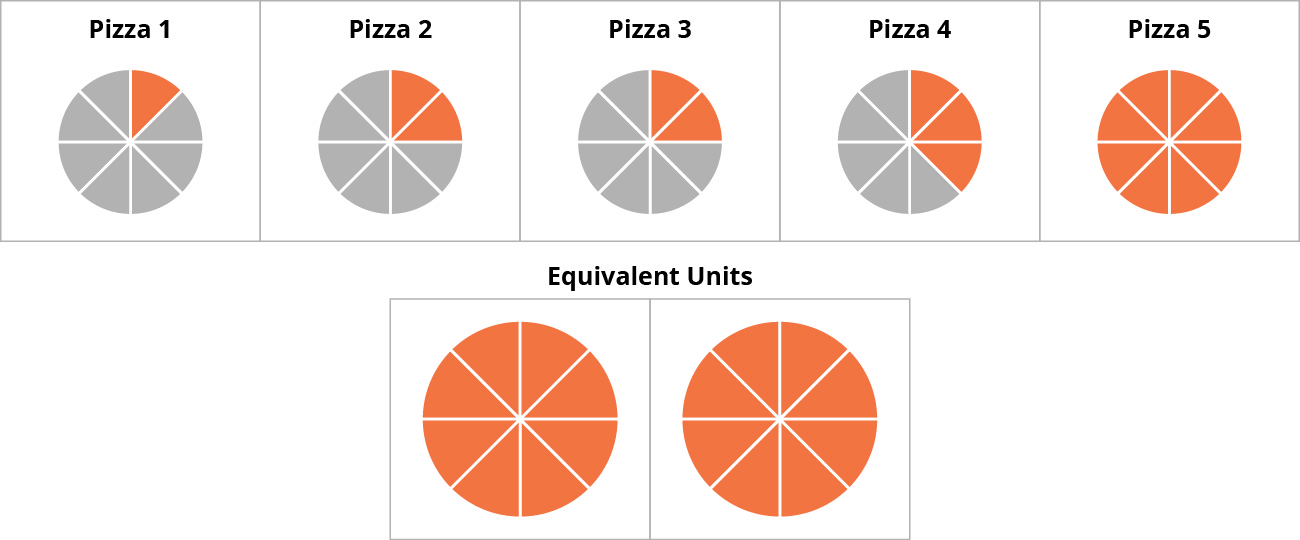

How does an arrangement determine the cost of each unit in a process costing environment? The costs in each department are allocated to the number of units produced in a given menses. This requires conclusion of the number of units produced, but this is not always an easy process. At the stop of the bookkeeping period, there typically are always units nonetheless in production, and these units are only partially complete. Call back of it this fashion: At midnight on the final 24-hour interval of the month, all bookkeeping numbers need to be determined in gild to process the financial statements for that month, but the production process does not cease at the cease of each accounting catamenia. Even so, the number of units produced must be calculated at the end of the bookkeeping period to decide the number of equivalent units, or the number of units that would have been produced if the units were produced sequentially and in their entirety in a particular fourth dimension catamenia. The number of equivalent units is different from the number of actual units and represents the number of full or whole units that could accept been produced given the amount of endeavour applied. To illustrate, consider this analogy. You lot take five large pizzas that each contained viii slices. Your friends served themselves, and when they were finished eating, there were several partial pizzas left. In equivalent units, decide how many whole pizzas are left if the remaining slices are divided equally shown in (Effigy).

- Pie one had one slice

- Pie ii had two slices

- Pie three had two slices

- Pie 4 had three slices

- Pie v had eight slices

Together, at that place are sixteen slices left. Since there are eight slices per pizza, the leftover pizza would be considered 2 full equivalent units of pizzas. The equivalent unit is determined separately for directly materials and for conversion costs as part of the computation of the per-unit of measurement cost for both material and conversion costs.

Equivalent Units. (attribution: Copyright Rice University, OpenStax, nether CC BY-NC-SA iv.0 license)

Major Characteristics of Process Costing

Process costing is the optimal organization for a visitor to employ when the production process results in many similar units. It is used when production is continuous or occurs in large batches and it is difficult to trace a item input cost to a specific individual product.

For example, before David and William plant ways to brand v big cookies per batch, their family always fabricated one big cookie per batch. In order to make five cookies at a time, they had to get together the ingredients and baking materials, including five bowls and v cookie sheets. The exact amount of ingredients for one large cookie was mixed in each carve up basin then placed on the cookie sheet. When this method was used, it was easy to establish that exactly one egg, two cups of flour, three-quarter cup of chocolate chips, three-quarter cup of sugar, one-quarter teaspoon common salt, so along, were in each cookie. This made it easy to determine the exact cost of each cookie. But if David and William used ane bowl instead of five bowls, measured the ingredients into it and and so divided the dough into 5 large cookies, they could not know for certain that each cookie has exactly ii cups of flour. One cookie may have ane 7/eight cups and another may have i 15/16 cups, and one cookie may have a few more chocolate chips than another. Information technology is also impossible to trace the chocolate chips from each bag to each cookie because the chips were mixed together. These variations practise not affect the taste and are not important in this type of bookkeeping. Process costing is optimal when the products are relatively homogenous or indistinguishable from 1 another, such as bottles of vegetable oil or boxes of cereal.

Frequently, procedure costing makes sense if the individual costs or values of each unit of measurement are not significant. For example, it would not be toll effective for a eatery to make each loving cup of iced tea separately or to track the direct textile and directly labor used to make each viii-ounce glass of iced tea served to a customer. In this scenario, job order costing is a less efficient accounting method because information technology costs more to track the costs per viii ounces of iced tea than the cost of a batch of tea. Overall, when it is difficult or not economically feasible to runway the costs of a product individually, process costing is typically the best cost system to use.

Procedure costing tin also accommodate increasingly complex concern scenarios. While making drumsticks may sound simple, an immense amount of applied science is involved. Rock City Percussion makes eight,000 hickory sticks per day, four days each week. The sticks made of maple and birch are manufactured on the fifth day of the week. It is difficult to tell the get-go drumstick made on Mon from the 32,000th i made on Th, then a computer matches the sticks in pairs based on the tone produced.

Process costing measures and assigns the costs to the associated department. The basic 5A hickory stick consists only of hickory every bit directly material. The rest of the manufacturing process involves direct labor and manufacturing overhead, then the focus is on properly assigning those costs. Thus, process costing works well for simple production processes such as cereal, rubber, and steel, and for more complicated production processes such as the manufacturing of electronics and watches, if there is a degree of similarity in the production process.

In a process cost organization, each department accumulates its costs to compute the value of work in process inventory, so at that place will be a piece of work in process inventory for each manufacturing or product department also as an inventory cost for finished goods inventory. Manufacturing departments are often organized by the various stages of the production process. For example, blending, baking, and packaging could each be categorized as manufacturing or production departments for the cookie producer, while cutting, assembly, and finishing could be manufacturing or production departments with accompanying costs for a furniture manufacturer. Each section, or process, will have its ain piece of work in process inventory account, but at that place volition but exist i finished goods inventory account.

There are two methods used to compute the values in the work in process and finished goods inventories. The kickoff method is the weighted-average method, which includes all costs (costs incurred during the current menses and costs incurred during the prior period and carried over to the current period). This method is often favored, considering in the process cost production method there often is little product left at the stop of the period and most has been transferred out. The 2nd method is the first-in, first-out (FIFO) method, which calculates the unit of measurement costs based on the assumption that the start units sold come from the prior flow's piece of work in process that was carried over into the current period and completed. After these units are sold, the newer completed units can then be sold. The theory is similar to the FIFO inventory valuation procedure that y'all learned about in Inventory. (Since the FIFO process costing method is more complicated than the weighted-average method, the FIFO method is typically covered in more advanced accounting courses.)

With processing, it is difficult to establish how much of each material, and exactly how much time is in each unit of finished product. This will crave the use of the equivalent unit computation, and direction selects the method (weighted average or FIFO) that all-time fits their information organisation.

Process costing can besides be used past service organizations that provide homogeneous services and often do not have inventory to value, such as a hotel reservation system. Although they accept no inventory, the hotel might want to know its costs per reservation for a period. They could allocate the full costs incurred past the reservation system based on the number of inquiries they served. For example, assume that in a year they incurred costs of $200,000 and served 50,000 potential guests. They could determine an average toll by dividing costs past number of inquiries, or $200,000/fifty,000 = $4.00 per potential invitee.

In the example of a not-for-profit company, the aforementioned process could be used to determine the average costs incurred past a section that performs interviews. The department's costs would be allocated based on the number of cases processed. For example, assume a not-for-profit pet adoption organization has an almanac upkeep of $180,000 and typically matches 900 shelter animals with new owners each year. The average price would exist $200 per lucifer.

Similarities betwixt Process Costing and Job Order Costing

Both process costing and job social club costing maintain the costs of straight textile, direct labor, and manufacturing overhead. The process of production does non alter because of the costing method. The costing method is chosen based on the production procedure.

In job social club price production, the costs tin can be directly traced to the job, and the job toll sheet contains the full expenses for that job. Process costing is optimal when the costs cannot exist traced directly to the job. For case, information technology would exist impossible for David and William to trace the exact amount of eggs in each chocolate chip cookie. It is as well impossible to trace the exact amount of hickory in a drumstick. Even two sticks made sequentially may accept different weights considering the forest varies in density. These types of manufacturing are optimal for the process cost system.

The similarities between task gild price systems and process cost systems are the product costs of materials, labor, and overhead, which are used make up one's mind the toll per unit of measurement, and the inventory values. The differences between the 2 systems are shown in (Effigy).

| Differences betwixt Job Society Costing and Process Costing | |

|---|---|

| Chore Order Costing | Process Costing |

| Production costs are traced to the product and recorded on each chore'due south individual task cost sheet. | Product costs are traced to departments or processes. |

| Each department tracks its expenses and adds them to the task cost sheet. As jobs motion from one department to some other, the job price canvass moves to the next department likewise. | Each section tracks its expenses, the number of units started or transferred in, and the number of units transferred to the next department. |

| Unit costs are computed using the chore price canvas. | Unit costs are computed using the departmental costs and the equivalent units produced. |

| Finished goods inventory includes the products completed but not sold, and all incomplete jobs are work in process inventory. | Finished goods inventory is the number of units completed at the per unit cost. Work in process inventory is the cost per unit and the equivalent units remaining to be completed. |

Choosing Between Process Costing and Job Order Costing

Procedure costing and chore club costing are both acceptable methods for tracking costs and production levels. Some companies use a single method, while some companies utilize both, which creates a hybrid costing system. The organisation a company uses depends on the nature of the product the visitor manufactures.

Companies that mass produce a product classify the costs to each section and apply process costing. For example, General Mills uses process costing for its cereal, pasta, baking products, and pet foods. Task lodge systems are custom orders because the cost of the direct material and direct labor are traced directly to the job beingness produced. For example, Boeing uses job gild costing to industry planes.

When a company mass produces parts but allows customization on the final product, both systems are used; this is common in automobile manufacturing. Each function of the vehicle is mass produced, and its cost is calculated with process costing. Withal, specific cars have custom options, and then each individual motorcar costs the sum of the specific parts used.

Direct or Indirect Material

Around Again is a wooden frame manufacturer. Forest and fastener metals are typically added at the showtime of the process and are hands tracked every bit direct material. Sometimes, afterwards inspection, the product needs to be reworked and boosted pieces are added. Because the frames accept already been through each department, the additional piece of work is typically minor and oftentimes entails simply adding an additional fastener to keep the back of the frame intact. Other times, all the frame needs is additional glue for a corner slice.

How does a company differentiate between direct and indirect fabric? Many direct material costs, as the wood in the frame, are easy to identify as direct costs because the fabric is identifiable in the concluding product. Merely not all readily identifiable fabric is a direct material cost.

Technology makes it easy to track costs as pocket-sized equally one fastener or ounce of mucilage. However, if each fastener had to exist requisitioned and each ounce of glue recorded, the product would accept longer to make and the directly labor toll would be college. So, while information technology is possible to rail the cost of each individual production, the additional data may not be worth the boosted expense. Managerial accountants work with management to decide which products should be accounted for as straight textile and tracked individually, versus which should be considered indirect material and allocated to the departments through overhead application.

Should Effectually Again consider the fasteners or gum added after inspection every bit direct material or indirect fabric?

Primal Concepts and Summary

- The three categories of costs incurred in producing an item are direct fabric, straight labor, and manufacturing overhead.

- Procedure costing is the organisation of accumulating costs within each department for large-book, mass-produced units.

- Process costing often groups straight labor and manufacturing overhead as conversion costs.

- Costs under GAAP are categorized equally menstruation costs when they are not related to production and instead cover a time flow.

- Selling and authoritative costs are period costs related to the sales of products and management of the company and are not directly tied to a specific product.

- Procedure costing determines the cost per unit through the employ of equivalent units, or the number of units that would have been produced if product was sequential instead of in batches.

(Figure)Which of the following product characteristics is improve suited for process costing and not task order costing?

- Each product batch is distinguishable from the prior batch.

- The costs are easily traced to a specific product.

- Costs are accumulated past department.

- The value of work in process is the direct material used, the direct labor incurred, and the overhead practical to the job in procedure.

(Figure)A process costing organization is near likely used past which of the following?

- airplane manufacturing

- a paper manufacturing company

- an accounting firm specializing in tax returns

- a hospital

(Effigy)Which of the post-obit is a prime toll?

- direct labor

- work in process inventory

- administrative labor

- factory maintenance expenses

(Figure)Which of the following is a conversion cost?

- raw materials

- direct labor

- sales commissions

- direct material used

(Effigy)During production, how are the costs in process costing accumulated?

- to toll of appurtenances sold

- to each individual product

- to manufacturing overhead

- to each individual section

(Effigy)Explain how process costing differs from job society costing.

Answers will vary but should include the following:

| Expanse | Process | Job Club |

|---|---|---|

| Types of jobs | Identical | Custom social club |

| Quantity within each job | Large volume | Small volume |

| Cost accumulation | In each department | In each task |

(Figure)Would a pharmaceutical manufacturer use process or job order costing? Why?

(Figure)Which costs are assigned using the weighted-average method?

The weighted-average method assigns the beginning inventory and the costs added during the menstruum. The weighted-boilerplate method does not differentiate betwixt the beginning inventory and the units started in production. This is different from the FIFO method that accounts for the beginning inventory differently and separately from current period costs.

(Figure)What is the primary purpose of process costing?

(Effigy)How many units were started into production in a period if in that location were zero units of beginning work in process inventory, one,100 units in ending work in process inventory, and 21,500 completed and transferred out units?

(Figure)A company started a new production, and in the first month started 100,000 units. The ending work in process inventory was 20,000 units that were 100% complete with materials and 75% consummate with conversion costs. There were 100,000 units to business relationship for, and the equivalent units for materials was $vi per unit of measurement while the equivalent units for conversion was $viii per unit. What is the value of the inventory transferred out, using the weighted-average inventory method?

(Figure)The post-obit product costs are available for Haworth Company on the production of chairs: direct materials, $15,500; directly labor, $22,000; manufacturing overhead, $16,500; selling expenses, $six,900; and authoritative expenses, $15,200.

- What are the prime costs?

- What are the conversion costs?

- What is the total product cost?

- What is the total menses toll?

- If vii,750 equivalent units are produced, what is the equivalent material cost per unit?

- If 22,000 equivalent units are produced, what is the equivalent conversion toll per unit?

(Figure)The following production costs are available for Arrez Company on the production of DVD cases: straight materials, $1,450; direct labor, $fifteen.50; manufacturing overhead, applied at 150% of direct labor cost; selling expenses, $ane,550; and administrative expenses, $950. The direct labor hours worked for the month are ninety hours.

- What are the prime costs?

- What are the conversion costs?

- What is the full product cost?

- What is the full menses cost?

- If 1,450 equivalent units are produced, what is the equivalent material toll per unit of measurement?

- What is the equivalent conversion price per unit?

(Effigy)How would procedure costing exist in a service industry?

Footnotes

- ane Katy Vine. "Just Desserts." Texas Monthly. Oct 2010. https://features.texasmonthly.com/editorial/simply-desserts/

- 2 Federal Bureau of Investigation (FBI). "Former Collin Street Bakery Executive and Wife Sentenced." September xvi, 2015. https://www.fbi.gov/contact-united states/field-offices/dallas/news/printing-releases/erstwhile-collin-street-baker-executive-and-wife-sentenced

Glossary

- conversion price

- full of labor and overhead for a product; the costs that "catechumen" the direct textile into the finished product

- equivalent units

- number of units that would have been produced if the units were produced sequentially and in their entirety in a particular time period

- expense recognition principle

- (besides, matching principle) matches expenses with associated revenues in the period in which the revenues were generated

- manufacturing costs

- (also, product costs) full of all costs expended in the manufacturing process; more often than not consists of direct material, direct labor, and manufacturing overhead

- period costs

- typically related to a detail time period instead of attached to the production of an asset; treated as an expense in the menstruum incurred (examples include many sales and administrative expenses)

- prime costs

- directly material expenses and directly labor costs

- process costing

- costing system used when a standardized procedure is used to industry identical products and the direct material, direct labor, and manufacturing overhead cannot be traced to a specific unit

- product costs

- all expenses required to manufacture the product: direct materials, direct labor, and manufacturing overhead

- selling and administrative (Southward&A) expenses

- catamenia costs non direct assigned to the items produced or services provided; include costs of departments not direct associated with manufacturing but necessary to operate the business

Source: https://opentextbc.ca/principlesofaccountingv2openstax/chapter/compare-and-contrast-job-order-costing-and-process-costing-2/

0 Response to "A Job Costing System Can Be Used by Which Types ofã¢â‚¬â€¹ Companies?"

Post a Comment